Most parents constantly look for investment avenues that could help them financially secure their child’s future. Through such investment, they look to build a sizable corpus to help them pay for the higher education needs of their children.

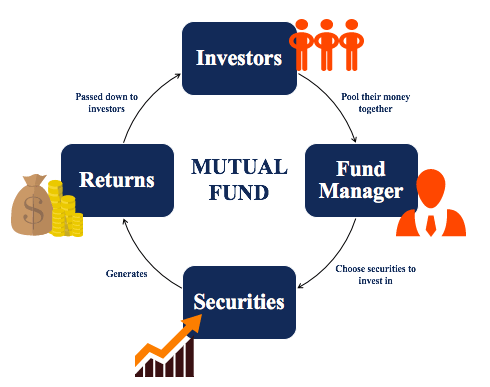

Investing in mutual funds for children to cater to expected future expenditures is a popular option. A mutual fund investment in a child’s name can be done either through a systematic investment plan (SIP) or through a one-time investment of a lump sum amount.

Mutual fund investments can be made in the name of a minor child (less than 18 years of age). Before you decide to invest in a mutual fund for a minor, it is prudent to understand the process.

How can I invest in the name of my minor child?

You can invest any amount (no restriction on the minimum/maximum amount) in the name of your minor child. Any monetary gifts received by your child could be redirected to the mutual fund investment. As this kind of mutual fund cannot be held jointly, it will thus be held in the name of your child. The fund portfolio will have either of the parents designated as the guardian. Wherever required, a guardian could be legally appointed by a court.

Payments for such a fund, be it lumpsum or via SIP, are sourced from the designated guardian’s bank account. The payments for an SIP can also come from the child’s minor account, which in turn will be subject to the designated guardianship. Such an SIP on the minor’s name will cease to exist once your child attains the age of 18. Starting from the date of attaining 18 years, the child becomes the investor and will then need to go through the normally prescribed KYC process.

What are the documents required for a mutual fund investment in a child’s name?

Submitting two documents is mandatory for mutual fund investment in a child’s name:

- Proof of date of birth

- Proof of relationship between the designated guardian and the child

Copy of your child’s birth certificate or a copy of their passport is considered a valid document for the purpose. For legally appointed guardians, a copy of the relevant court order is required.

In case there is a requirement to change the designated guardian, a no-objection certificate (NOC) is required to be obtained from the existing guardian. For legally appointed guardians, a fresh court order nominating the new guardian will be required.

Are there any tax implications?

As per the current stipulations of the Income Tax Act, income accrued via dividends/capital gains through funds held in the name of the minor will be added to the taxable income of the designated guardian. The dividends and capital gains earned are tax-free if held beyond one year.

What are the actions required once the child turns 18?

When the child turns 18 years of age, the mutual fund firm will stop the SIP. The firm will intimate the guardian and the minor of the cessation of the SIP.

The concerned minor will be required to provide the required documentation to change their status from ‘minor’ to an individual investor. Once the necessary change to account status as ‘major’ has been made, the SIP can be resumed.

Thus, investing in your minor child’s name could help you meet your child’s short- and long-term financial needs. This could prove extremely beneficial for you as you wouldn’t have to bear the additional financial burdens while trying to secure your child’s future.